Foreign investment regulation

Australia has a foreign investment approval regime that regulates acquisitions by ‘foreign persons’ of equity securities in Australian companies and trusts, and of Australian businesses and Australian real property assets. The regime is set out in the FATA (being the Foreign Acquisitions and Takeovers Act 1975 (Cth) and its accompanying regulations).

Under the FATA, a ‘foreign person’ is generally:

- an individual that is not ordinarily resident in Australia;

- a foreign government or foreign government investor;

- a corporation, trustee of a trust or general partner of a limited partnership where an individual not ordinarily resident in Australia, foreign corporation or foreign government holds an equity interest of at least 20 per cent; or

- a corporation, trustee of a trust or general partner of a limited partnership in which two or more foreign persons hold an aggregate equity interest of at least 40 per cent.

A transaction that is subject to the FATA approval regime should not be implemented unless the Australian Treasurer has ‘approved’ the transaction via the issuance of a no-objection notice. Therefore, a transaction that needs approval should be conditional upon the receipt of that approval.

In deciding whether to approve a proposed transaction, the Australian Treasurer has the benefit of advice from the Foreign Investment Review Board (FIRB). The Australian Treasurer can block proposals by foreign persons that are contrary to the national interest, or alternatively approve proposals on an unconditional basis or subject to conditions. Whether a proposed transaction is contrary to the national interest is assessed on a case-by-case basis. These national interest factors are described in more detail below.

Applications for foreign investment approval are submitted to FIRB.

When approval is required

The rules regarding when approval (commonly referred to as ‘FIRB approval’) is required under the FATA are complex. There is a layered system of categories, exceptions and multiple thresholds.

In a situation where no special rules apply (there are many – see further below), a foreign person needs FIRB approval to acquire a substantial interest (20 per cent plus) via the issue or transfer of securities2 if the target is:

- an Australian company carrying on an Australian business;

- an Australian unit trust; or

- a holding entity of either of them,

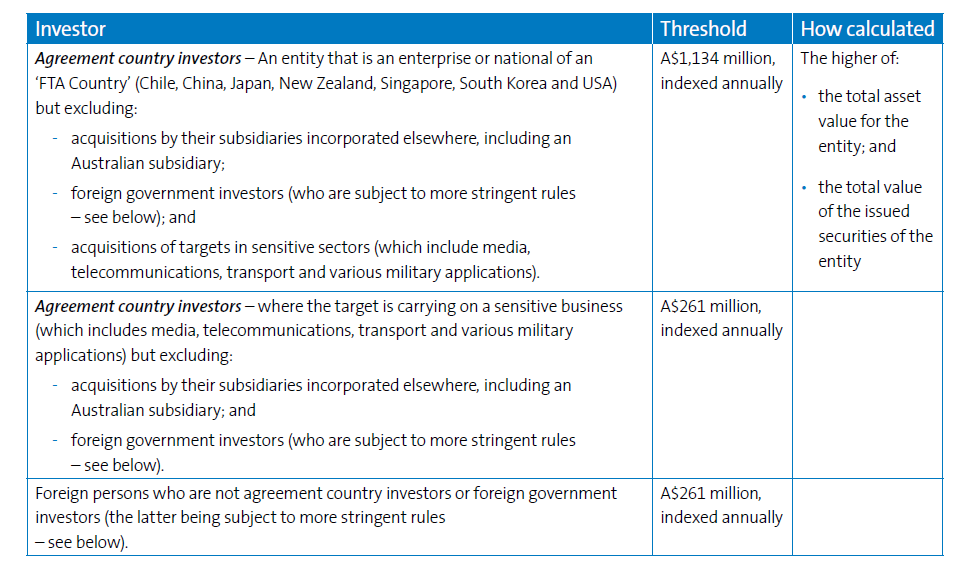

where the target is valued above the following thresholds:

Special rules apply in a number of situations, including as follows.

- (Foreign government investors) There are different rules for investments by a foreign government investor compared with private investors. Foreign government investors are subject to more rigorous screening than other investors – all foreign government investors acquiring a direct interest (which is generally 10 per cent but may be less depending on the

circumstances) in an Australian entity require FIRB approval and there is no monetary threshold that applies before FIRB approval is required. Many commercial investors that operate independently are counted as foreign government investors –not only sovereign wealth funds and state owned enterprises, but also many entities that have part government ownership upstream.

- (Agribusiness) All foreign persons (other than those noted below) acquiring a direct interest (which is generally 10 per cent but may be less depending on the circumstances) in an agribusiness for consideration of A$57 million or more (including the value of any existing investment in that agribusiness) must obtain FIRB approval before proceeding.

- An agribusiness entity is one that:

— derives earnings from carrying on one or more businesses in a prescribed class of agricultural businesses that represent more than 25 per cent of the entity’s EBIT; or — uses assets in carrying on one or more such businesses and the value of the assets exceeds 25 per cent of the total asset value of the entity.

However, this A$57 million threshold does not apply to enterprises or nationals of USA, Chile or New Zealand. They are instead subject to the usual A$1,134 million thresholds noted in the above table.

- (Media sector) Any acquisition by a foreign person of 5 per cent or more in an Australian media business requires FIRB approval.

- (Land-rich entities) Any acquisition by a foreign person of securities in an Australian land corporation or trust (being a corporation or trust where interests in Australian land account for more than 50 per cent of the entity’s total assets) requires FIRB approval, except acquisitions of less than 10 per cent (for listed entities) or 5 per cent (for widely held unlisted entities) where there is no influence over management or policy.

Separate legislation (not administered by FIRB) includes other requirements and/or imposes limits on foreign investment in the following instances:

- the Financial Sector (Shareholdings) Act 1998 (Cth) imposes a 15 per cent limit on individual ownership (whether by an Australian or foreign person) in an Australian bank or insurance company, unless the Australian Treasurer approves the particular person owning a higher percentage;

- the Air Navigation Act 1920 (Cth) imposes a 49 per cent limit on aggregate foreign ownership in any Australian international airline and the Qantas Sale Act 1992 (Cth) imposes such a limit in respect of Qantas);

- the Airports Act 1996 (Cth) imposes a 49 per cent limit on aggregate foreign ownership of some airports, a 5 per cent individual airline ownership limit and also cross-ownership limits between Sydney airport (together with Sydney West) and either Melbourne, Brisbane or Perth airports;

- the Shipping Registration Act 1981 (Cth) requires a ship to be majority Australian-owned if it is to be registered in Australia,unless it is designated as chartered by an Australian operator; and • the Telstra Corporation Act 1991 (Cth) imposes a 35 per cent limit on aggregate foreign ownership of Telstra (a telecommunications company) and individual foreign owners are only allowed to own a maximum of 5 per cent.

Assessment of the national interest (for all foreign investors)

The FATA requires the Australian Treasurer to consider whether proposed investment transactions are contrary to Australia’s national interest. Whilst the FATA does not define the concept of ‘national interest’, nor provide any guidelines on how it is to be assessed, the Australian Government’s Foreign Investment Policy paper (the Policy) states that the Government typically considers five factors when assessing foreign investment proposals. In summary, these are:

- National security: The extent to which investments affect the Australian Government’s ability to protect the strategic and security interests of Australia.

- Competition: Whether a proposed investment may result in an investor gaining control over market pricing or production of a good or service in Australia.

- Other Australian government policies (including tax): What impact the proposed investment will have on Australia’s tax revenues or environment impact objectives. Depending on the circumstances surrounding the proposed investment and its potential impact on Australian tax revenue, FIRB may approve the investment subject to certain ‘tax conditions’ being imposed on the foreign investor. The conditions range in their degree of severity depending largely on the Government’s perception of the degree of tax risk the transaction poses.

For example, the conditions may vary from, broadly, requiring the foreign investor to comply, and using its best endeavours to ensure that all members of its ‘control group’ comply, with Australian tax law, to engaging with the ATO in good faith to resolve any tax issues in relation to the transaction and holding of the investment and providing to the ATO a forecast of tax payable in relation to the transaction or investment.

- Impact on the economy and the community: What level of Australian participation will remain after the proposed investment occurs, and what will be the consequences for employees, creditors and other stakeholders.

- Character of the investor: The extent to which the investor operates on a transparent commercial basis and is subject to adequate and transparent regulation and supervision.

Assessment of the national interest (for foreign government investors only)

The Policy states that, where a proposal involves a foreign government investor, the Australian Government will also consider whether the investment is commercial in nature or if the investor is pursuing broader political or strategic objectives that may be contrary to Australia’s national interest.

Policy indicates that the Government will have regard to:

- the relevant foreign government investor’s governance arrangements;

- where the foreign government investor is not wholly foreign government-owned, the size, nature and composition of non-foreign government interests in the foreign government investor; and the extent to which the foreign government investor operates on an arm’s length, commercial basis.

The Policy goes on to say that mitigating factors that assist in determining that such proposals are not contrary to Australia’s national interest may include:

- the existence of external partners or shareholders in the investment;

- the level of non-associated ownership interests;

- the governance arrangements for the investment;

- ongoing arrangements to protect Australian interests from non-commercial dealings; and

- whether the target will be, or will remain, listed on the ASX or another recognised exchange.

The Policy also states that the Government will also consider the size, importance and potential impact of such investments in considering whether or not the proposal is in the national interest.

Fees and timing

Applicants for FIRB approval are required to pay a fee for each application made. Fees are imposed for considering applications,not for approvals, and must be paid before an application will be considered. FIRB’s time limit to consider the application does not start until the fee is paid. In respect of business and company acquisitions, the fee payable is: A$2,000 where the consideration is A$10 million or less; A$25,300 where the consideration is above A$10 million and not more than A$1 billion; and A$101,500 where the consideration is in excess of A$1 billion.

Once an application for FIRB approval has been lodged with FIRB (and the relevant application fee paid) there is a statutory time period for the Australian Treasurer to make a decision and, if no decision is made, then no further orders can be made (that is, the Australian Treasurer cannot prohibit or unwind a transaction if a decision is not made in time). The general rule is that the Australian Treasurer has 30 days to make a decision and a further 10 days to notify the applicant. However, there are several ways that this timeframe can be extended:

- if the Australian Treasurer requests information and documents from a person in relation to the application, the clock stops until the request has been satisfied;

- the Australian Treasurer may also make an interim order (which is publicly available) which has the effect of prohibiting a transaction on a temporary basis (up to 90 days), effectively extending the time for the Australian Treasurer to make a final decision; or

- an applicant can request that the timeframe be extended (which it may wish to do to avoid a public interim order being made).

Despite the statutory time period there is no certainty that foreign investment approval will be given by a particular time given that either the Australian Treasurer or the applicant may take steps that extend that timeframe.In the vast majority of cases, approval is not a transaction completion risk – approval is granted for the overwhelming majority of applications.

Australian Government investment policy favourable to foreign investors

In recent years, Australia has enjoyed unprecedented high rates of foreign investment. According to FIRB’s 2015-2016 annual report, during the year ended 30 June 2016 a total of 43,013 applications were considered, with 41,445 approved, five rejected,1,319 withdrawn and 244 exempt as not subject to the foreign investment approval requirements at the time in the Policy or the FATA.

Let Me Keep You Up-To-Date

Receive regular market news, trends and insights, business and investment opportunities in Australia and much more.